Fabulous Info About How To Buy A Roth Ira

These limits change on a yearly basis and are determined.

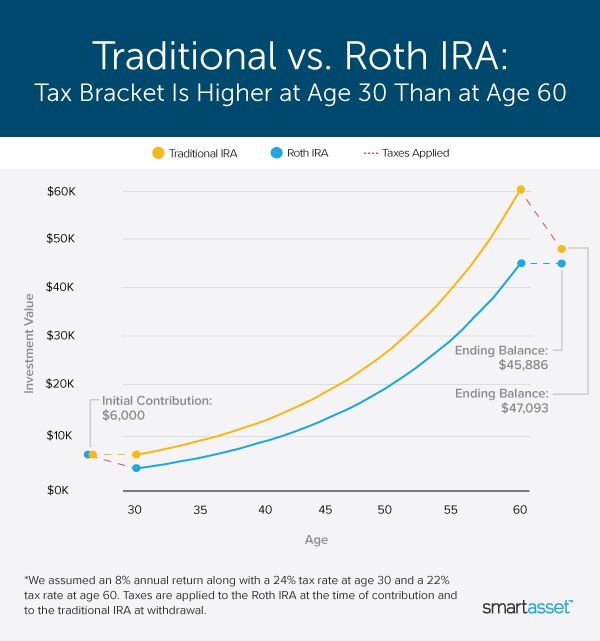

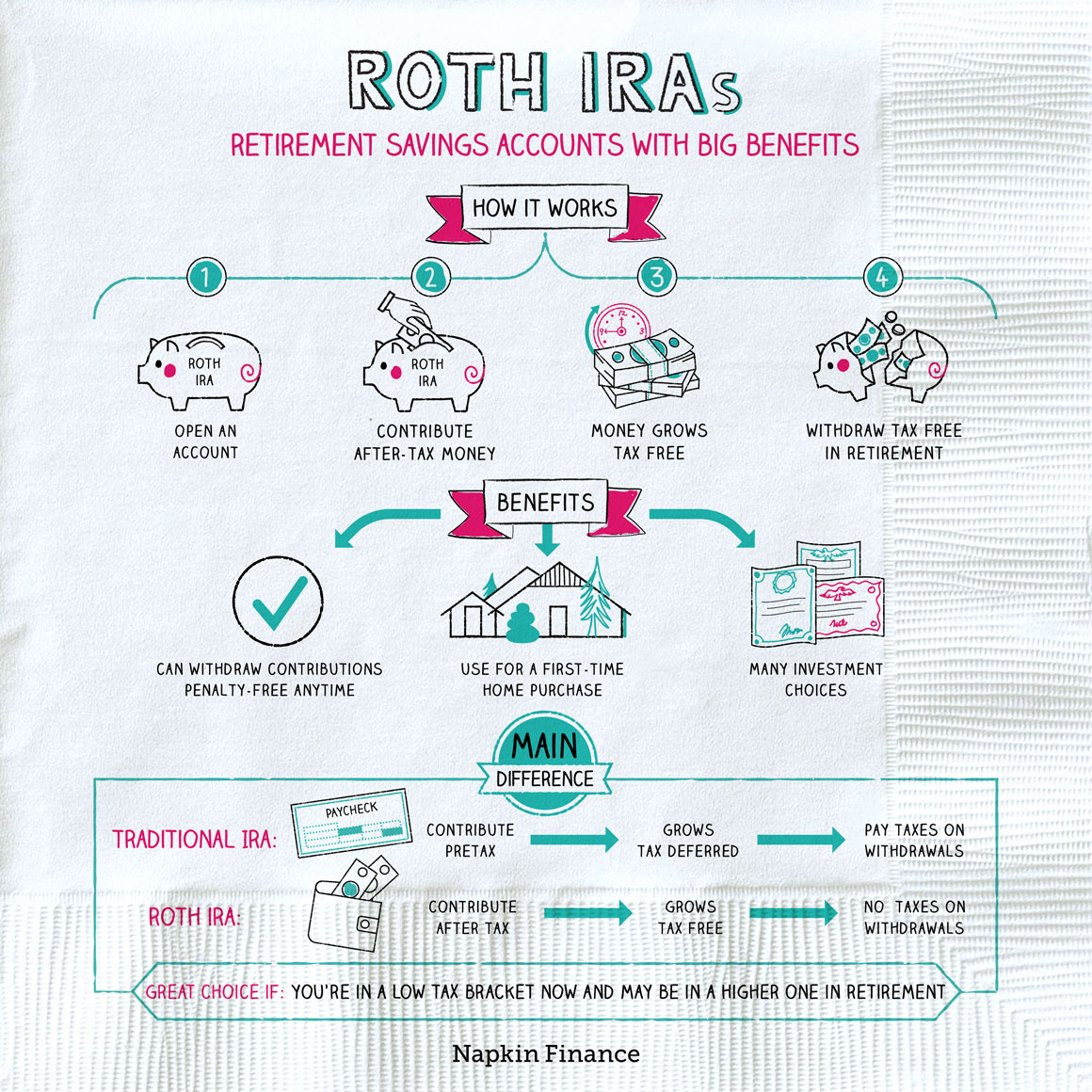

How to buy a roth ira. Like traditional iras, roth iras offer various tax benefits, and can be suitable accounts for the purchase of treasury bills. Below, the primary place for financial education i’m mosting likely to discuss 3 of the very best roth ira. One interesting thing about the caps the roth and traditional are 6k a year combined.

More than two hundred hours of research to provide the top financial knowledge. To reduce the chances you’ll get hit with taxes or unexpected penalties when making an early roth ira withdrawal for a home purchase, follow these steps: Open a roth ira account.

For the 2021 and 2022 tax years, you. Ad we reviewed the 10 best gold ira companies for you to protect yourself from inflation. House storage gold ira the house storage gold ira offers capitalists the ability to purchase physical precious metals like silver and gold without stressing over inflation or tax obligation.

Make sure your income meets the requirements set for the year in which you are applying for the ira. Have $50 million or more in assets. Ad wide range of investment choices, access to smart tools, objective research and more.

A roth ira is totally useless if you do not, spend the cash in your roth ira. Ad don't pay taxes when you withdraw your money after you retire. Ad build your own mix of investments to invest for income or growth.

The sooner you invest, the more opportunity your money has to grow. Require a minimum investment of $1,000 or less. Ad build your future with a firm that has 85 years of retirement experience.

Instead, the roth ira must purchase shares with its own assets in order to own shares. Everything that you need right here for you! You can contribute to both in a year but max is 6k.

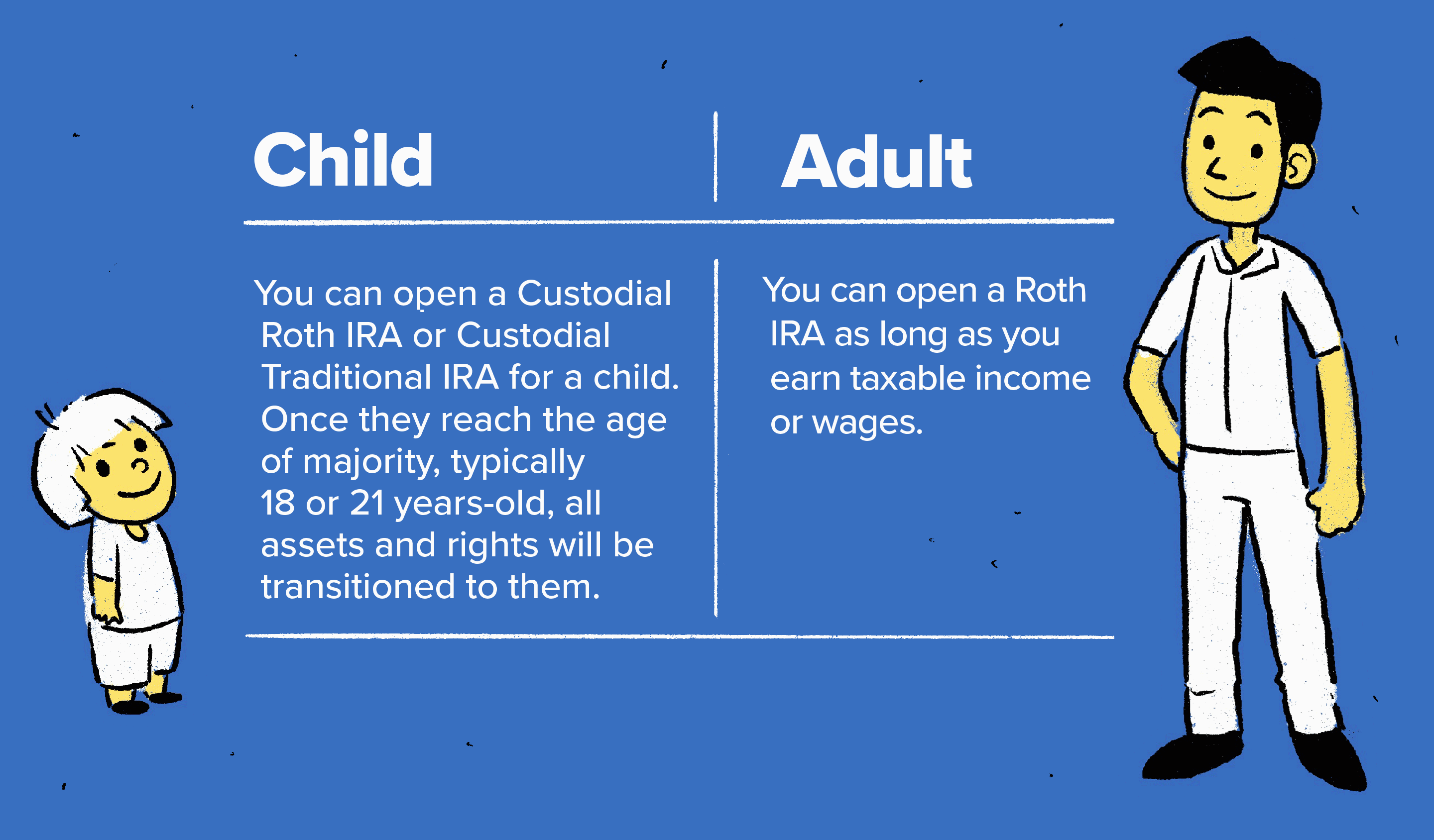

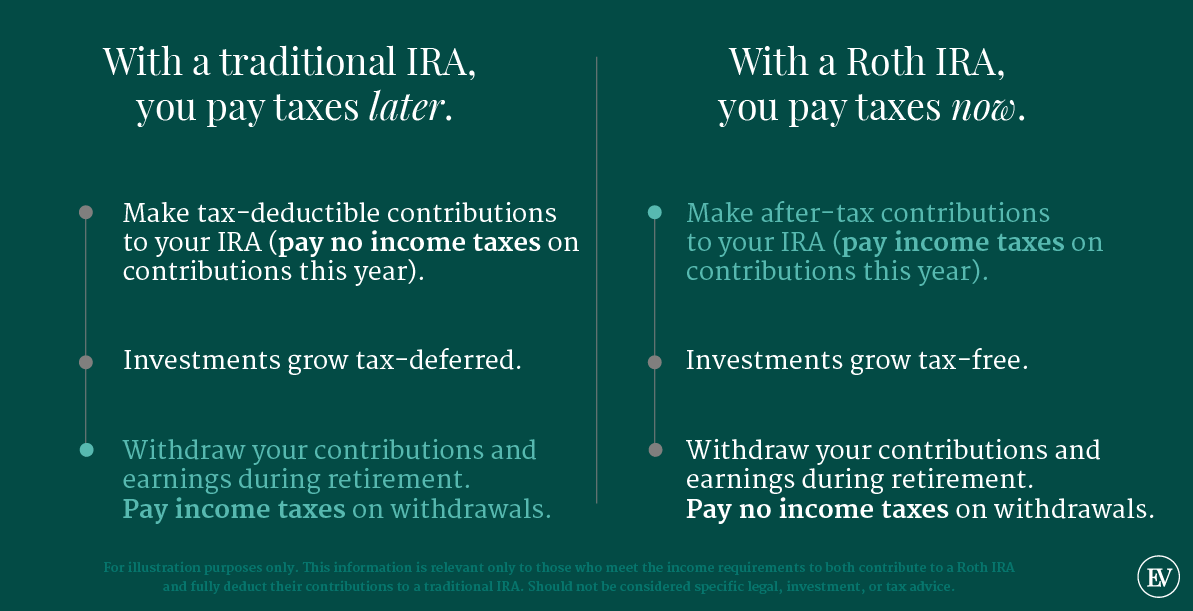

You cannot deduct contributions to a roth ira. Fzrox, fxnax, and fzilx are the best mutual funds for roth iras. A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira.

Td ameritrade offers a $0 account minimum and commissions of $9.99 per trade. A roth ira is a special type of individual retirement account. Get an analysis of your current portfolio, assess your financial situation, and find ideas to help you.

Additionally, you don't have to pay taxes when you make qualified withdrawals. Here are 3 ways to help get started when investing in an ira.

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)